Beyond the Sale: Goal Setting That Turns Transactions Into Partnerships

As the year winds down, most sales professionals are busy planning their next set of targets, more calls, more meetings, more revenue. But what if this December, you set goals that don’t just fill the pipeline… but fill the relationship?

The top 1% of sales professionals are not focused on closing more deals. They’re focused on opening more relationships, the kind that create loyalty, advocacy, and long-term growth.

This is the mindset shift that separates the transactional salesperson from the trusted advisor.

And it starts by redefining what success looks like in your sales process.

When you view every customer interaction through the lens of “how can I make this person’s life better?”, you instantly move from being a vendor to being a partner. Instead of asking, “Did I close them?” start asking, “Did I earn their trust?”

At your next team meeting, replace your closing metrics with relationship metrics.

Track things like:

· Referrals earned

· Repeat customers

· Personal check-ins made post-sale

Because influence isn’t measured in conversions, it’s measured in conversations.

Joey Coleman reminds us that the real work begins after the sale. If you don’t design the post-sale experience intentionally, you leave loyalty to chance.

Here’s a framework for 2026 goal setting:

Create experience goals alongside your revenue goals.

For example:

· Within 7 days post-sale: Send a personalized thank-you message or video.

· Within 30 days: Check in to ensure the customer feels supported and satisfied.

· Within 90 days: Surprise them with a “you made the right decision” touchpoint—something small but meaningful.

This isn’t just retention, it is reassurance, and reassurance builds long-term influence.

People don’t buy from the best most polished salesperson, they buy from the person who makes them feel like their story matters. That they matter, and that their a key story to tell.

Influence isn’t about authority. It’s about empathy, clarity, and consistency. When you help your customer win, they’ll make sure you win too.

Ask yourself before every goal you set:

“Does this goal help my customer look and feel like the hero of their story?”

If the answer is yes, you’re no longer selling, you’re leading. And that’s the ultimate differentiator.

Before setting new goals for next year, take 30 minutes this month to review your customer relationships:

· Which ones feel strong enough to last years, not months?

· Which customers trust you enough to recommend you without hesitation?

· Where can you add one small gesture to turn satisfaction into advocacy?

When you set goals that elevate the relationship instead of just the result, you move beyond the sale, and into real influence.

In the end, it’s not about how many deals you close. It’s about how many partnerships you open.

See you in 2026!

Master the Art of Influence: Build Trust, Drive Sales, and Lead Effectively

Are you ready to become the magnetic force that attracts top performers and your best customers?

I’m Kevin Sidebottom—keynote speaker, sales trainer, and author—and I help organizations unlock the power of influence to achieve breakthrough results.

In this blog, I reveal why influence is the ultimate currency in business and leadership—and how you can use it to:

✅ Motivate customers to stay loyal and buy again

✅ Build trust and engagement with your team

✅ Transform your leadership approach to inspire stronger performance

With decades of experience studying why people buy and how leaders earn loyalty, I equip sales professionals and executives to deliver lasting value, strengthen customer relationships, and drive higher revenue.

👉 Featured Resources to Grow Your Influence:

· Email: kevin@kevinsidebottom.com

· The Sales Process Uncovered Membership

· The Sales Process Uncovered (Book on Amazon)

If you’re serious about elevating your sales process, leadership impact, and team performance, this blog will show you the path.

Lead With Heart, Win With Clarity: The Blueprint for Goals That Build Unbreakable Teams

Most leaders set goals that sound good on paper such as revenue targets, engagement metrics, or retention numbers. But when the numbers take priority over the “why,” even the best teams quietly disconnect. The result? You hit your targets but lose your people.

Great leadership isn’t just about outcomes, it’s about creating cultures people never want to leave. As we move into a new year, here’s how to set heart-centered yet accountable goals that ignite your team’s purpose, clarity, and drive.

Before you decide what to achieve, get crystal clear on why your team exists. John Maxwell reminds us that “people buy into the leader before they buy into the vision.” As I share in my “Mastering Influence Keynote,” there are five buy in decisions that our employees need to buy before they will commit to the vision. And just like John Maxwell, the leader is the first decision.

Things you may want to ask your team:

· Why do we show up each day?

· Who are we really serving?

· What impact do we want to make together?

Purpose turns a goal from a number into a mission. When your team feels connected to a bigger reason, performance becomes personal. Buying in takes on a new meaning instead of hitting a metric.

Once the “why” is clear, translate it into team alignment. Patrick Lencioni’s Five Behaviors—trust, conflict, commitment, accountability, and results create the foundation we need for success with our teams. Set goals through these lenses:

· Do we trust each other enough to tell the truth about what’s working and what’s not?

· Are we willing to engage in healthy conflict to protect our mission?

· Can every person commit to the next steps without confusion or hidden agendas?

Clarity transforms ambition into movement. It keeps your team rowing in the same direction when challenges hit.

Purpose without accountability is potential wasted. Dave Ramsey’s EntreLeadership approach gives you a rhythm that keeps goals alive:

· Weekly: Review scoreboards and track progress out loud with the KPI’s.

· Monthly: Celebrate wins and recalibrate priorities.

· Quarterly: Reset with clarity, what’s next, what’s done, what’s dropped.

Accountability rhythms turn goals into habits. And habits create consistency which is the mark of every thriving team. The best teams don’t chase goals, they embody them. They know their purpose. They trust their process. They feel their work. They own their outcomes. When this happens, everyone wins!

Master the Art of Influence: Build Trust, Drive Sales, and Lead Effectively

Are you ready to become the magnetic force that attracts top performers and your best customers?

I’m Kevin Sidebottom—keynote speaker, sales trainer, and author—and I help organizations unlock the power of influence to achieve breakthrough results.

In this blog, I reveal why influence is the ultimate currency in business and leadership—and how you can use it to:

✅ Motivate customers to stay loyal and buy again

✅ Build trust and engagement with your team

✅ Transform your leadership approach to inspire stronger performance

With decades of experience studying why people buy and how leaders earn loyalty, I equip sales professionals and executives to deliver lasting value, strengthen customer relationships, and drive higher revenue.

👉 Featured Resources to Grow Your Influence:

· Email: kevin@kevinsidebottom.com

· The Sales Process Uncovered Membership

· The Sales Process Uncovered (Book on Amazon)

If you’re serious about elevating your sales process, leadership impact, and team performance, this blog will show you the path.

The Influence Audit: How Top Performers Set Goals That Actually Stick

As we close out the year, the familiar ritual begins: setting new goals. Again, it feels like we just did this. After a year full of market shifts, new regulations, and nonstop noise, it’s easy to wonder: is there a better way to do this?

The truth is, most people set goals based on what they hope to achieve, not the behaviors that actually create results. Hope-driven goals fade fast. But behavior-driven goals stick.

This year, instead of writing another list of targets, try conducting an Influence Audit, a practical, reflective process that identifies which habits, relationships, and systems truly moved the needle for your leadership, your team, and your business.

Ask yourself:

· Who did I impact this year, and how did that provide real ROI (Return on Influence)?

· Which customers, colleagues, or partners contributed the most to growth, innovation, or efficiency?

· What relationships helped us move faster or think clearer?

Influence always leaves evidence. Look for it in the form of trust built, partnerships deepened, or processes improved. Those are your multipliers.

The Pareto Principle is alive and well in every organization: 20% of actions produce 80% of outcomes. So, what made the difference this year?

· Was it a specific team or initiative that overdelivered?

· A new process that created efficiency?

· A behavior that turned potential into performance?

Once you’ve identified the high-impact 20%, study it. What mindset, environment, or decision unlocked that success? Influence grows when you understand its root cause.

Leaders often spotlight success briefly and move on to the next challenge. That’s a mistake. Let your high-performing teams and individuals teach what worked. Have them present their wins, lessons, and shifts in behavior to others. When you extend the spotlight, you expand ownership and influence spreads organically across the culture.

With insight from your audit, now you can set goals that actually matter. The question isn’t, “What should we do next year?”

It’s, “Which behaviors and beliefs created our biggest wins and how do we multiply them?”

Tie every new goal back to:

· Engagement: Does this goal make our team more connected and motivated?

· Efficiency: Does it simplify or streamline how we work?

· Impact: Does it drive measurable ROI, Return on Influence?

When you link goals to behaviors, results stop being random. They become repeatable.

Results without behavior change are just words on paper. The most successful leaders don’t chase goals, they audit their influence. They study what actually worked, celebrate it, and then scale it.

Before you plan another year, pause. Look at your impact.

Because the best goals aren’t about doing more, they’re about doing what matters most, on purpose, repeatedly.

Master the Art of Influence: Build Trust, Drive Sales, and Lead Effectively

Are you ready to become the magnetic force that attracts top performers and your best customers?

I’m Kevin Sidebottom—keynote speaker, sales trainer, and author—and I help organizations unlock the power of influence to achieve breakthrough results.

In this blog, I reveal why influence is the ultimate currency in business and leadership—and how you can use it to:

✅ Motivate customers to stay loyal and buy again

✅ Build trust and engagement with your team

✅ Transform your leadership approach to inspire stronger performance

With decades of experience studying why people buy and how leaders earn loyalty, I equip sales professionals and executives to deliver lasting value, strengthen customer relationships, and drive higher revenue.

👉 Featured Resources to Grow Your Influence:

· Email: kevin@kevinsidebottom.com

· The Sales Process Uncovered Membership

· The Sales Process Uncovered (Book on Amazon)

If you’re serious about elevating your sales process, leadership impact, and team performance, this blog will show you the path.

Beyond the Degree: Practical Programs That Transform Sales Careers by: Candace Simon

In sales, the pressure to stand out can feel relentless. Traditional degrees such as The University of Toledo’ s Edward Schmidt Sales Degree have long been viewed as the ticket to credibility, but the reality is shifting. Increasingly, professionals are finding that targeted, non-degree learning opportunities offer sharper tools, faster returns, and more flexible access. These programs aren’t framed by long semesters or steep tuition bills; they’re designed to create immediate, visible impact. For sales professionals, this means skill sets that influence conversations today rather than credentials that sit on a résumé tomorrow. What follows is an exploration of how executive coaching, public speaking workshops, and language learning platforms are reshaping career paths in ways that rival traditional higher education.

Why non-degree routes matter now

Formal education has value, but it can be slow to adapt to the demands of modern business. By contrast, skills-based, non-degree credentials are emerging as high-traction pathways because they are aligned directly to workplace needs. Instead of broad theory, these programs emphasize hands-on learning that solves real problems. For sales professionals, that might mean mastering objection handling, refining negotiation strategies, or strengthening relationship-building tactics. The power lies in immediacy—what you study today becomes usable in the very next client call.

The market for learning is evolving, and sales professionals are in a strong position to take advantage. The future of professional development lies in non-credit programs that emphasize adaptability and lifelong growth. Unlike degrees that may lock you into a single track, these opportunities invite exploration and experimentation. A language course taken today can lead to new markets tomorrow. A workshop completed this month might unlock your next promotion. The promise of non-degree learning is not just in affordability—it’s in its ability to evolve alongside you.

Coaching that accelerates professional growth

Working one-on-one with a coach provides accountability and sharpens self-awareness in ways most classrooms never could. Studies highlight five benefits of executive coaching, including heightened clarity in goal-setting, improved leadership behaviors, and greater resilience under pressure. For those in sales, coaching offers a safe environment to test strategies, dissect missteps, and prepare for high-stakes meetings. It transforms performance by focusing not on abstract principles but on specific patterns of behavior that can be adjusted quickly. A few sessions often uncover blind spots that years of solo trial and error would never reveal.

Workshops that sharpen presentation skills

Sales professionals often underestimate how much credibility hinges on delivery. Enrolling in programs that teachtechniques from public speaking workshops can change the way clients perceive you before you even reach the heart of your pitch. Small adjustments in tone, body language, or pacing can be the difference between a flat response and a handshake deal. These workshops are immersive, feedback-driven environments where you practice in front of others who are also eager to improve. The shared energy creates momentum, and with every iteration, your communication skills become sharper and more persuasive.

Language learning for cross-cultural success

Sales doesn’t stop at borders anymore, and cultural fluency can be a decisive advantage. One practical route is to learn Spanish with online Spanish classes that are personalized, flexible, and supportive of different learning styles. These sessions are human-led, which means you can progress at a pace that builds confidence while still fitting into your workday. The private and immersive format helps professionals pick up effective communication skills they can apply immediately in conversations with clients. For those expanding into new markets, this becomes more than an academic pursuit—it’s a practical and motivating way to deepen trust and speak like a native when it matters most.

Building persuasive confidence

Speaking up in front of a group isn’t just about projecting your voice. It’s about developing composure and presence that carries into every business interaction. The benefits of public speaking skills extend far beyond the podium. Strong communicators close more deals because they can frame solutions clearly, handle objections without losing balance, and maintain authority under pressure. The act of mastering public speech is a training ground for managing nerves, reading an audience, and creating trust quickly—all essential for sales professionals looking to build long-term client relationships.

Coaching inside the sales function

Coaching is not just for executives. In sales teams, structured programs are becoming one of the most reliable performance multipliers. Evidence shows that sales coaching boosts performance, not by offering a rigid script, but by tailoring improvement strategies to each rep’s strengths and weaknesses. This process reinforces repeatable behaviors that drive outcomes, whether that’s more effective prospecting, tighter closing ratios, or stronger account expansion. Teams that adopt coaching cultures tend to outperform because improvement is treated as a continuous loop, not a one-time training event.

Practical frameworks for selling

Many professionals are tired of sales clichés and buzzwords that overcomplicate the work. What they need is a grounded framework. Kevin Sidebottom’s Sales Workshop delivers this by stripping away gimmicks and focusing on a clear, customer-first process. His keynote, The Sales Process Uncovered, arms teams with practical tools that accelerate deal cycles and strengthen relationships. This isn’t theory for theory’s sake; it’s about applying a proven process that resonates across industries. The confidence teams gain translates directly into conversations where clarity and trust matter more than jargon.

Sales is about connection, clarity, and confidence. Degrees may still carry prestige, but they don’t always equip you for the immediacy of client demands. Executive coaching helps refine how you show up under pressure. Public speaking workshops polish the way you command a room. Language learning builds bridges where cultural gaps might otherwise limit opportunities. Non-credit programs provide an efficient, accessible path that fits real business realities. For sales professionals, these alternatives aren’t secondary options; they’re primary engines of growth that prove personal development doesn’t have to be formal to be transformational.

Some Questions I Often Hear About This Topic

Q1: Are non-degree programs really respected in professional settings?

Yes. Employers increasingly value demonstrated skills, and programs that provide direct, measurable results are taken seriously, especially in performance-driven fields like sales.

Q2: How do I choose between coaching, workshops, or language learning?

Start with your immediate growth needs. If confidence in communication is the issue, public speaking workshops help. If strategy and process matter, coaching is key. For expanding into global markets, language learning is essential.

Q3: Do these programs take a lot of time?

Most are designed to be efficient. Coaching sessions may run an hour, workshops often span a weekend, and language classes can be scheduled flexibly around your work.

Q4: How affordable are these alternatives compared to a degree?

They’re typically far less costly. Many workshops or language courses can be taken for the cost of a single textbook in a traditional program.

Q5: Can these skills translate into immediate career growth?

Absolutely. Improvements in communication, cultural fluency, and sales process mastery directly affect how you perform in client meetings, negotiations, and leadership opportunities.

Master the Art of Influence: Build Trust, Drive Sales, and Lead Effectively

Are you ready to become the magnetic force that attracts top performers and your best customers?

I’m Kevin Sidebottom—keynote speaker, sales trainer, and author—and I help organizations unlock the power of influence to achieve breakthrough results.

In this blog, I reveal why influence is the ultimate currency in business and leadership—and how you can use it to:

✅ Motivate customers to stay loyal and buy again

✅ Build trust and engagement with your team

✅ Transform your leadership approach to inspire stronger performance

With decades of experience studying why people buy and how leaders earn loyalty, I equip sales professionals and executives to deliver lasting value, strengthen customer relationships, and drive higher revenue.

👉 Featured Resources to Grow Your Influence:

· Email: kevin@kevinsidebottom.com

· The Sales Process Uncovered Membership

· The Sales Process Uncovered (Book on Amazon)

If you’re serious about elevating your sales process, leadership impact, and team performance, this blog will show you the path.

Making Tie-Backs a Habit in Every Sales Conversation

You don’t rise to the level of your goals, you fall to the level of your habits.

Salespeople know tie-back questions work. They’ve seen the lightbulb moments when customers connect a feature to their own outcome. But here’s the trap: tie-backs are often used as a tactic, not a discipline.

One big demo? They use them.

Quarter-end deal push? They use them.

Everyday calls? Not so much.

The real power comes when tie-back questions become automatic, woven into every conversation until they’re a behavior.

Here’s a practical structure you can practice until it’s instinct:

1. Listen actively.

Capture the exact words your customer uses. Don’t paraphrase into sales jargon.

Example: Customer says, “We’re buried in manual reporting.”

2. Connect back.

Use their words in a question that ties directly to your product.

Example: “If reporting were automated, how much time would that free up for your analysts?”

3. Anchor outcomes.

Reinforce the link between their answer and your product’s value.

Example: “That’s exactly why our reporting module exists, to give teams back 10+ hours a week.”

This cycle turns features into outcomes, and outcomes into reasons to act.

When done well, tie-back questions don’t sound like a script. They sound like curiosity. The customer barely notices you’re guiding them toward your solution.

Poor example (feels forced):

· “Our product improves efficiency. Wouldn’t that be good for you?”

Better example (feels natural):

· “You mentioned efficiency is a priority. If this cut your team’s workload by 30%, how would that change things?”

The difference is subtle, but it builds trust.

When tie-back questions become behavior, you stop “selling features” altogether. Your conversations shift:

· From what your product does → to what it means for them.

· From explaining benefits → to having them describe the impact.

· From transactional deals → to trusted advisor relationships.

That’s where influence lives. That’s where trust grows. And that’s where deals close faster, and new opportunities start piling up.

Have a great week!

Master the Art of Influence: Build Trust, Drive Sales, and Lead Effectively

Are you ready to become the magnetic force that attracts top performers and your best customers?

I’m Kevin Sidebottom—keynote speaker, sales trainer, and author—and I help organizations unlock the power of influence to achieve breakthrough results.

In this blog, I reveal why influence is the ultimate currency in business and leadership—and how you can use it to:

✅ Motivate customers to stay loyal and buy again

✅ Build trust and engagement with your team

✅ Transform your leadership approach to inspire stronger performance

With decades of experience studying why people buy and how leaders earn loyalty, I equip sales professionals and executives to deliver lasting value, strengthen customer relationships, and drive higher revenue.

👉 Featured Resources to Grow Your Influence:

· Email: kevin@kevinsidebottom.com

· The Sales Process Uncovered Membership

· The Sales Process Uncovered (Book on Amazon)

If you’re serious about elevating your sales process, leadership impact, and team performance, this blog will show you the path.

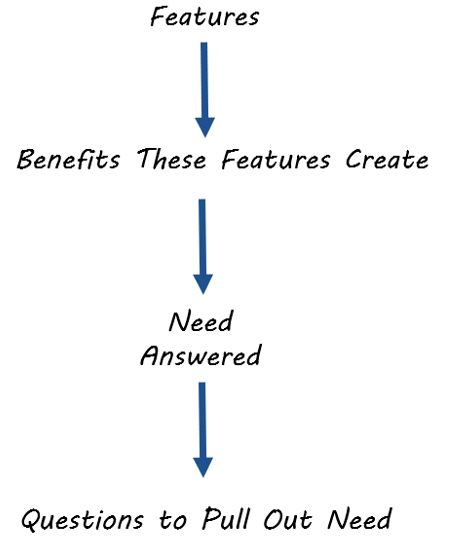

The Tie Back Formula

Over the past few weeks we have been talking about this mystical formula and how well it works for sales and leadership to gain engagement. Today we learn the process for creating the tie back questions and start adding a tool to our toolbox for better sales and engagement.

Most salespeople know they should sell benefits, not features. But here’s the twist: the best way to highlight benefits isn’t by telling, it’s by asking.

That’s where tie-back questions come in.

A tie-back question connects your product’s features to the customer’s real-world needs. The stronger the question, the clearer the benefit becomes, and the more the customer convinces themselves of your value.

Grab a sheet of paper. Write your product’s features across the top. Under each, list the benefit. Then, under the benefit, list the need it answers.

Example: In my trainings, I use a clicker with a button that blanks out the slide.

· Feature: Slide blanking button

· Benefit: Audience attention shifts back to me

· Need: Refocus the group when making a key point

Once you know the need, craft questions that highlight it.

For the blank-slide feature, I might ask:

· “Would it be valuable if you could instantly refocus your audience during a presentation?”

· “How much more influence would you have if you could pause the slides to drive home a critical point?”

Notice what’s happening: I’m not pitching the button. I’m pulling the customer into imagining how much better their world looks with the benefit.

Below is the complete process of creating the questions that tie back your features and benefits:

Back when I sold stand-on lawnmowers (before they were a thing), I didn’t start with horsepower or specs. Instead, I asked questions like:

· “Have you ever had employees get stuck when a mower tipped near a retention pond?”

· “How do your crews handle steep inclines today safely?”

These questions tied directly to the mower’s feature, standing design with easy step-off, and the benefit: greater safety and maneuverability. Customers quickly connected the dots themselves and could see the advantage that the product was offering them. A safter way operate and have less lawsuits!

Tie-back questions do three things:

1. Expose real needs. You find out if the feature actually matters.

2. Highlight benefits naturally. The customer says “yes” to their own pain points.

3. Build alignment. By the time you present, you’re not pitching, you’re confirming.

Using this process with your products you will be able to make higher levels of engagement in your meetings with customers and gain traction / speed on their decision making. This is the essence of how we can make larger sales with the sales cycle decreasing.

The best part…When the customers start seeing the benefit you bring to them, they can’t help but tell all their collegues in the industry to contact you. Then your prospecting becomes more efficient allowing you to have more freedom and income in your pocket.

Does that sound like a value to you? If so, implement this and see how well it works for you. If you have questions reach out!

Master the Art of Influence: Build Trust, Drive Sales, and Lead Effectively

Are you ready to become the magnetic force that attracts top performers and your best customers?

I’m Kevin Sidebottom—keynote speaker, sales trainer, and author—and I help organizations unlock the power of influence to achieve breakthrough results.

In this blog, I reveal why influence is the ultimate currency in business and leadership—and how you can use it to:

✅ Motivate customers to stay loyal and buy again

✅ Build trust and engagement with your team

✅ Transform your leadership approach to inspire stronger performance

With decades of experience studying why people buy and how leaders earn loyalty, I equip sales professionals and executives to deliver lasting value, strengthen customer relationships, and drive higher revenue.

👉 Featured Resources to Grow Your Influence:

· Email: kevin@kevinsidebottom.com

· The Sales Process Uncovered Membership

· The Sales Process Uncovered (Book on Amazon)

If you’re serious about elevating your sales process, leadership impact, and team performance, this blog will show you the path.

Driving Urgency w/ Tie Backs

You’ve probably been there: a customer nods along, agrees with your points, even tells you your solution looks strong, and then they stall for months when you follow up asking about next steps.

“Let’s revisit next quarter.”

“We need more time to think.”

“It’s not urgent right now.”

The frustration is real. The value is obvious, yet the decision lingers. Why? Because people naturally avoid risk. Taking action, spending money, adopting a new tool, changing a process feels risky. Waiting feels safe. That is why we need to be making sure we are asking the right questions to help them understand the waiting is actually hurting them.

This is where tie-back questions become a game-changer. They don’t just connect your product to a problem; they connect inaction to consequences.

Tie-back questions that drive urgency usually focus on two things:

1. The cost of doing nothing

2. The benefit of acting now

Imagine this exchange:

Customer: “Collaboration between departments is slow.”

Seller: “If this continues for six more months, how much do you estimate it will cost in missed opportunities?”

That question reframes the problem from an annoyance to a measurable loss. Suddenly, inaction looks expensive.

Then pivot to the positive:

Seller: “If we solved this today, how quickly could you start hitting your quarterly goals?”

Now urgency isn’t about fear, it’s about speed and results.

Behavioral economics tells us people are twice as motivated to avoid loss as they are to pursue gain. Tie-back questions tap into that bias by making inaction visible.

At the same time, you can’t only push on pain. Hope motivates too. The balance is critical:

· Highlight the cost of delay. (Loss avoidance)

· Show the upside of speed. (Hope for gain)

When both levers are pulled, urgency rises.

Tie-back questions don’t just connect your product to value, they shine a spotlight on the hidden costs of waiting and the visible rewards of acting now.

And when customers see both, hesitation turns into momentum.

Have a great week!

Master the Art of Influence: Build Trust, Drive Sales, and Lead Effectively

Are you ready to become the magnetic force that attracts top performers and your best customers?

I’m Kevin Sidebottom—keynote speaker, sales trainer, and author—and I help organizations unlock the power of influence to achieve breakthrough results.

In this blog, I reveal why influence is the ultimate currency in business and leadership—and how you can use it to:

✅ Motivate customers to stay loyal and buy again

✅ Build trust and engagement with your team

✅ Transform your leadership approach to inspire stronger performance

With decades of experience studying why people buy and how leaders earn loyalty, I equip sales professionals and executives to deliver lasting value, strengthen customer relationships, and drive higher revenue.

👉 Featured Resources to Grow Your Influence:

· Email: kevin@kevinsidebottom.com

· The Sales Process Uncovered Membership

· The Sales Process Uncovered (Book on Amazon)

If you’re serious about elevating your sales process, leadership impact, and team performance, this blog will show you the path.

Building Trust Through Tie-Backs

In sales, trust is the currency that moves prospects into customers, and customers into partnerships. Not the partnerships where the buyer says they want to be a partner as long as it benefits them.

Without trust, even the best product won’t be bought. Tie-back questions help us earn that trust by proving we are not just waiting for our turn to pitch. No, we are genuinely paying attention to the customer.

Here’s how it looks in practice:

· Customer: “We’re under pressure to reduce costs.”

· Seller: “If this solution lowered your overhead by 15%, how would that free up resources for other priorities?”

This approach shifts the spotlight back on the customer. It says: “I hear you, and I want to explore how this impacts your bigger goals.”

Now, if we are going to make a statement like 15% reduction in overhead, we better make sure we can back that up with data. Now this is a big step because we have better understood the customer’s business before offering up something like this. We better have case studies, or something of proof to show how we can in fact do this like testimonials. You get the point though that the customer will be more likely to lean in if we are asking some questions that mirror what they have stated in the past.

The same thing happens when we are in leadership. Our employees are just like customers asking themselves if the leadership is even listening to the employees. Nothing worse than an environment where there is no trust in leadership. All the top performers start leaving in droves while the employees we wish would leave stay. Want to talk about a toxic culture…

Leaders need to use tie back questions as well to make sure the employees feel like they are heard, valued, and matter as well. Without employees feeling this way, the engagement empties faster than a container of sweet tea at a southern BBQ!

When leaders are talking with their employees, they should be asking their employees questions to learn about them not just to answer task-oriented questions.

· Employee: “I am failing to see how my work is helping the organization, or customers.”

· Leader: “By you running the financial proforma of a product offering the sales team is looking to launch, we can avoid negative profit margins resulting in having to take cost out later driving the quality and sales into the ground” Does this help you see the value you are brining to the team and the organization?

When you tie back like this, you’re not guessing, you’re confirming. And when customers or employees feel understood, they begin to see you as a partner that they will want to work with for years instead of months.

Master the Art of Influence: Build Trust, Drive Sales, and Lead Effectively

Are you ready to become the magnetic force that attracts top performers and your best customers?

I’m Kevin Sidebottom—keynote speaker, sales trainer, and author—and I help organizations unlock the power of influence to achieve breakthrough results.

In this blog, I reveal why influence is the ultimate currency in business and leadership—and how you can use it to:

✅ Motivate customers to stay loyal and buy again

✅ Build trust and engagement with your team

✅ Transform your leadership approach to inspire stronger performance

With decades of experience studying why people buy and how leaders earn loyalty, I equip sales professionals and executives to deliver lasting value, strengthen customer relationships, and drive higher revenue.

👉 Featured Resources to Grow Your Influence:

· Email: kevin@kevinsidebottom.com

· The Sales Process Uncovered Membership

· The Sales Process Uncovered (Book on Amazon)

If you’re serious about elevating your sales process, leadership impact, and team performance, this blog will show you the path.

This Type of Question Will Increase Your Sales Overnight

Far too often customers dread the sales call as they expect the sales person to come in and feature and benefit them to death. Sales conversations can easily drift into “feature dumping”, listing all the bells and whistles of the product, but customers don’t buy features. They buy to satisfy their needs and outcomes.

Until I started utilizing a certain type of questions in my conversations with customers, it was a slog with mostly no’s at the end of the sales call. This different type of questioning really gets the customers to sit up with an engaging posture and they really start feeling like they are being heard. I have had customers still call me from time to time that I have not called on in years because of these questions.

The great thing about these questions is that they don’t take a certain degree, silver tongue to articulate, or some kind of super power. Anyone can use these questions and start accelerating their wins.

These kinds of questions are called tie-back questions. The tie back questions and the process I teach students is something so simple that I even witnessed my son do it to my mother asking about chocolate ice cream. Imagine my shock when a six-year old looked at me as my mother served him up a heaping bowl of ice cream as he looked at me and winked!

I guess he does listen from time to time!

Tie-back questions are questions that we structure using our product offering and we formulate questions from what our product offering does. It’s really simple once we start breaking this process down to take whatever product / service we are selling.

Imagine a customer says, “We’re frustrated with how long onboarding takes.” Instead of nodding and moving on, you ask:

· “If we cut onboarding time in half, how would that help your team hit results faster?”

This does two things:

1. It shows you were listening.

2. It invites the customer to link your product’s benefit directly to their business need in order to move forward.

Suddenly, onboarding isn’t just a feature, it’s a solution tied to performance, time savings, and team morale.

Next week we will discuss how tie back questions build higher levels of trust.

Master the Art of Influence: Build Trust, Drive Sales, and Lead Effectively

Are you ready to become the magnetic force that attracts top performers and your best customers?

I’m Kevin Sidebottom—keynote speaker, sales trainer, and author—and I help organizations unlock the power of influence to achieve breakthrough results.

In this blog, I reveal why influence is the ultimate currency in business and leadership—and how you can use it to:

✅ Motivate customers to stay loyal and buy again

✅ Build trust and engagement with your team

✅ Transform your leadership approach to inspire stronger performance

With decades of experience studying why people buy and how leaders earn loyalty, I equip sales professionals and executives to deliver lasting value, strengthen customer relationships, and drive higher revenue.

👉 Featured Resources to Grow Your Influence:

· Email: kevin@kevinsidebottom.com

· The Sales Process Uncovered Membership

· The Sales Process Uncovered (Book on Amazon)

If you’re serious about elevating your sales process, leadership impact, and team performance, this blog will show you the path.

The Game-Changer: Turning Answers into Action

Questions are powerful. They build trust, uncover needs, and spark new ideas. But here’s the catch: questions alone don’t create change. What we do with the answers does.

Leaders and sales professionals often fall into the trap of asking, but not acting. When employees or customers share their insights, and nothing happens, engagement erodes. People think, “Why bother speaking up?”

The real game-changer isn’t the question itself, it’s proving that the answer matters. Here’s how to make that shift:

Below are three things when done after asking questions will help move the needle and engagement forward with employees and customers:

Document and repeat back what we hear to confirm clarity.

People feel valued when they know they’ve been heard. After a conversation, restate what we’ve captured:

· “So what I’m hearing is that faster turnaround time is your top priority, correct?”

· “You’re saying the biggest challenge for your team is cross-department communication, right?”

Repeating back serves two purposes: it confirms that I have heard you and if I didn’t I am wanting to learn so please correct me.

Translate answers into specific next steps.

Listening without action is lip service. Once we’ve clarified the answer, we need to show how it translates into concrete movement.

· With a client: “Since quick implementation matters most, let’s schedule a demo this week and map out a 30-day rollout.”

· With a team member: “Because communication is the blocker, I’ll set up a weekly cross-team huddle and give you ownership of the agenda.”

When people see their input drive action, engagement skyrockets.

Close the loop by sharing outcomes.

The final and most overlooked— tep is closing the loop. Circle back and show how their input made a difference.

· “You mentioned faster turnaround. Since we streamlined the process, your requests are being completed in half the time.” “Is that what you are seeing as well?”

· “You told me cross-team collaboration was broken. Since we added the weekly huddle, issues are being resolved twice as fast.” “Is this improving the collaboration?”

Closing the loop turns feedback into proof. It builds trust and reinforces that their voice isn’t just heard it matters.

Anyone can ask questions. Few leaders and sellers consistently act on the answers. That’s why this step is the game-changer.

Document. Translate. Close the loop.

When we do, we don’t just collect insights we build trust, create momentum, and prove that every voice truly matters. When this happens, it’s like adding rocket fuel to what we are trying to do which moves the needle faster than ever.

Leading Through Questions: A Parable on Unlocking Engagement

A farmer once had two fields.

In the first field, he gave his workers strict instructions every morning. “Did you water this row? Did you remove those weeds? Did you finish by noon?” The workers followed the orders, but their energy was low. They did just enough to avoid being scolded. The harvest was small.

In the second field, the farmer tried something different. Instead of barking tasks, he asked:

· “What support do you need to succeed today?”

· “What do you see that could help this field grow stronger?”

· “What’s one improvement we could make together?”

The workers lit up. They shared ideas he never would have thought of like adjusting irrigation, rotating crops, even creating new planting methods. Because the farmer asked, they owned the field’s success. That harvest was abundant.

Command-and-control questions shut people down. Supportive questions open them up. When leaders shift from inspection to empowerment, employees stop working out of fear and start working out of commitment. Energy goes up as well as speed. That means that things happen faster, and people start winning with more abundance. Employees actually look forward to coming back the next day.

Just as the farmer discovered unseen problems in the soil, leaders uncover hidden challenges when they ask curious questions. Employees often know what slows progress, but they won’t share it unless asked. Leadership curiosity makes it safe and employees are willing to share solutions.

Workers in the second field also weren’t told what to do, they were invited to think. Questions that inspire ownership spark creativity, innovation, and accountability. That’s how teams grow into contribution instead of just showing up. They feel like they are part of a solution and that ownership allows them freedom to do more.

Leadership isn’t about having all the answers. It’s about asking the right questions.

Like the farmer, you can choose what kind of field you lead: one where people do the bare minimum, or one where engagement, ownership, and ideas flourish.

Ask better questions. Reap a larger harvest.

The Sales Professional’s Shift That Builds Real Influence

Too many “sales professionals” get so amped up for a customer meeting after months of prospecting, curating, and getting the date scheduled. They show up the day of the meeting with their slide decks memorized and ready to dazzle the customer with their brilliance.

They show up to the meeting get the pleasantries completed, business cards passed out, and they are on their way of bullet point after bullet point about how great their solutions are for the customer. The next thing they know is that 50 minutes have gone by and the customer says something to the effect of that’s great and don’t call us we will call you.

The sales professional feels like they did a great job and when they don’t hear anything after a while, they start reaching out to find that the customer is ghosting them. That’s right, no answer to emails, phone messages, DM’s on Instagram, nothing….

The problem is that the sales person assumed they knew all that the customer was going through and missed the mark. When I teach the tie-back questions portion of “The Sales Process Uncovered,” the participants typically have the understanding why they are not hearing back from the prospects.

This is where we start learning questions like below to start the meetings with the customers:

· “What would success look like for your team six months from now?”

· “What’s been the most frustrating part of your current setup?”

· “Can you give me an example?”

Customers do not want to be pitched to, or hear how great you or your product offering is. What they want to know is how will this solution make “THEM” the hero of their story. They need to feel known and heard, not pitched to. Nothing erodes trust faster than some slick sales person pretending to know all of their problems.

Customers are all unique and have small twists to the issues sales professionals might think they are solving. By missing the twist the sales professional misses the sale. Sales professionals using their generic script will gloss over these twists and then the customer will start losing trust, interest, and patients. Now most are polite, but I have seen some customers call for an end to the meeting and walk out. Where do you think I learned this lesson from?

To help customers feel like they are being heard and are known the sales professional has to make sure they are asking the best questions and learning about the situation before they start presenting the solutions. I wrote about this in a previous blog post about how Curiosity can be your superpower.

All the top performers use curiosity to start the process off and move forward with the customer as a guide to help them in their quest to be a hero of their story. Sales Professionals need to stop selling and start asking if they are going to be top perfomers as well.

From Selling to Solving: How the Right Questions Build Trust

In sales and in leadership the fastest way to lose trust is to start talking before you start listening. The best advice I had with this concept was that we have two ears and one mouth, so we should be listening twice as much as we talk. The best leaders and sales professionals lead with questions, not answers.

Asking the right questions changes everything. It shifts the dynamic to solving. Instead of pushing an agenda, you’re pulling out insights. Instead of assuming, you’re learning. Instead of talking at people, you’re building with them.

Here’s why questions are the ultimate trust-builder:

Questions demonstrate curiosity and respect—not assumption.

When you lead with statements, you risk signaling: I already know what’s best for you. But when you lead with questions, you communicate something far more powerful: I respect you enough to learn from your perspective and to know you.

Curiosity disarms people. It lowers resistance. Imagine sitting across from a customer who expects you to pitch—but instead, you ask, “What’s the biggest obstacle holding your team back right now?” Suddenly, they’re not being sold to; they’re being heard.

In leadership, the same principle applies. Asking an employee, “What do you need from me to do your best work?” shows more respect than assuming you know their answer. Questions create a culture where people feel seen, heard, and not just another number.

The right questions reveal hidden challenges.

Customers rarely lay their toughest problems on the table right away. Employees won’t always speak up about what frustrates them. That’s why the right questions act like keys to unlock what’s really going on.

Surface-level conversations give you surface-level insights. But when you ask deeper, questions like “What’s the part of this process that takes the most time?” or “What’s something that would make your workday easier?” we start getting beyond polite answers.

This is where real trust starts to build. Because when you uncover the hidden challenge, you can address the issue that truly matters. And when people feel understood at that level, they’re far more likely to trust your solutions.

Asking builds credibility.

It may feel counterintuitive, but the less you talk early on, the more credible you appear later. Why? Because people trust those who listen before prescribing.

Think of a doctor who listens carefully to your symptoms before diagnosing. You’d never trust a doctor who interrupts you after one sentence with, “I know exactly what’s wrong.” Customers and employees feel the same way. By asking questions first, you prove you’re not pushing a one-size-fits-all answer—you’re tailoring a solution to their reality.

Every question is a credibility deposit. Over time, those deposits accumulate into authority, influence, and trust. And once you have trust, your recommendations carry far more weight.

The next time you walk into a meeting, conversation, or sales call, don’t lead with your solution, but with curiosity. Because when you ask the right questions, you stop being just another voice trying to push something. You become the trusted partner who helps solve what really matters.

Make Them The Hero!

Two weeks ago in the post about how consistency builds trust with the customers I referenced this week’s title. This is a crucial secret of all for becoming a successful sales professional. That is: Sales isn’t about you. It’s about the customer.

I know some of you did a “wait, what?”

That’s right making a sale is not about selling a product or service to a customer. It’s about helping them to be a hero of their story.

Why Customers Need to Be the Hero

Too many salespeople want to be the center of the story—the one with the slick pitch, the clever answers, the grand solution. But customers don’t buy to make us look good. They buy because it makes them look feel like they are winning in their story.

· 74% of buyers choose the sales rep who first adds value and insight to their journey (Demand Gen Report).

· Buyers who feel understood are 3x more likely to purchase (Forrester).

Customers want someone that will be in their corner to help them succeed in their endeavors, not to say, “Kevin was such a great sales professional, I just had to buy from him.” They are not looking for the best skilled sales professional to shine the spotlight on, they want to show the world how great of a deal maker they are, how awesome of a purchase they made, how they have just leveled up to take on the world.

How to Make Customers the Hero

1. Frame solutions around them – Instead of “Here’s what we do,” shift to “Here’s how this helps you reach your goals.” Focus on them in the language.

2. Connect them to resources – Sometimes value isn’t selling your product, it’s introducing them to someone who can solve another problem. I call this being the bridge and it has netted me future sales because the customer could not help but recommend me to friends and family.

3. Celebrate their wins – When they succeed, shine the spotlight on them, not yourself. Let them know they are valued and that you support them and are glad you could be a part of their journey.

Think of yourself as the guide in the customer’s story—like Mickey to Rocky Balboa You’re not the main character; you’re the one who equips the customer to win their fight, hopefully with a knock out in the first round!

We still need to focus on the process, but if we put the customer’s needs first we will be able to be a part of their success story and others will start coming to us for requests instead of us having to hunt for more business.

Have a great week!

Master the Art of Influence: Build Trust, Drive Sales, and Lead Effectively

Are you ready to become the magnetic force that attracts top performers and your best customers?

I’m Kevin Sidebottom—keynote speaker, sales trainer, and author—and I help organizations unlock the power of influence to achieve breakthrough results.

In this blog, I reveal why influence is the ultimate currency in business and leadership—and how you can use it to:

✅ Motivate customers to stay loyal and buy again

✅ Build trust and engagement with your team

✅ Transform your leadership approach to inspire stronger performance

With decades of experience studying why people buy and how leaders earn loyalty, I equip sales professionals and executives to deliver lasting value, strengthen customer relationships, and drive higher revenue.

👉 Featured Resources to Grow Your Influence:

· Email: kevin@kevinsidebottom.com

· The Sales Process Uncovered Membership

· The Sales Process Uncovered (Book on Amazon)

If you’re serious about elevating your sales process, leadership impact, and team performance, this blog will show you the path.

The Hidden Power of Reviewing Every Call

Here’s a secret most salespeople ignore:

The call doesn’t end when you hang up the phone.

That’s right, most sales people walk out of a customer, hang up the phone, read the email and think they are done and on to the next customer. Fun fact, when I was learning how to waterski, it took me something like five years to get up on two skies. I also drank a lot of lake water in the process. Each time I failed I had to figure out what went wrong and how I could improve. When something happened well I quickly thought about it to figure out what the heck I just did.

Sales is the same. If we are not figuring out where we went wrong, or how we did something well, how are we going to repeatably win? As discussed last week consistency is key so we need to figure out what we can improve on and how we can execute well.

This takes reflection.

Why Reflection Matters

Research shows only 21% of salespeople consistently analyze their calls (CSO Insights). This is why the rate of success is around 29%. Without consistent improvement how will things get better? Knowing that most professionals are not doing this can be our super hero advantage to help the customer and win more sales.

What to Review After Every Call

1. What worked well? – Identify the questions that opened the conversation or the moments when the customer leaned in. What topics were discussed that the customer really was interested in.

2. Where did I lose influence? – Notice points where the buyer hesitated, disengaged, or changed tone. Where did the customer start interrupting your presentation to learn about a topic more? Where did they say stop…I have heard enough and we are going to move in a different direction. Yes that has happened to me before.

3. What will I do differently next time? – One small adjustment compounds into massive improvement over time. One percent improvement each day for a year nets a large return on investment. That means we will improve our presentation skills, improve our aim to hit the mark, build a resiliency muscle, and win more sales.

It doesn’t have to take long—5 minutes after every call can transform your trajectory. Focus on reviewing the “game film” for those athletes (I was not). Learn and get better each day and you will have a successful career in sales.

Have a great week!

Master the Art of Influence: Build Trust, Drive Sales, and Lead Effectively

Are you ready to become the magnetic force that attracts top performers and your best customers?

I’m Kevin Sidebottom—keynote speaker, sales trainer, and author—and I help organizations unlock the power of influence to achieve breakthrough results.

In this blog, I reveal why influence is the ultimate currency in business and leadership—and how you can use it to:

✅ Motivate customers to stay loyal and buy again

✅ Build trust and engagement with your team

✅ Transform your leadership approach to inspire stronger performance

With decades of experience studying why people buy and how leaders earn loyalty, I equip sales professionals and executives to deliver lasting value, strengthen customer relationships, and drive higher revenue.

👉 Featured Resources to Grow Your Influence:

· Email: kevin@kevinsidebottom.com

· The Sales Process Uncovered Membership

· The Sales Process Uncovered (Book on Amazon)

If you’re serious about elevating your sales process, leadership impact, and team performance, this blog will show you the path.

The Power of Consistency in Building Trust

Last week we started talking about why sales professionals do not win every sale. This week lets shift the focus on how we can start to increase the likelihood that we will win more sales as well as increasing profits.

Today’s discussion will focus around trust and how we built that trust.

Trust is the real currency of sales. And trust isn’t built in one meeting, it’s built over time, and through consistency. Fun fact: it takes on average 8-12 touches to secure an initial meeting according to the Rain Group in 2023 and 80% of sales people quit after the first attempt according to salesforce.

That means there needs to be more attempts consistently in order to move the needle with customers. The dream of the homerun after the first at bat is just that a dream. Sometimes they happen, sometimes people actually reach out to me for events. That is not the normal though and those that sit and wait for the phone to ring are the ones that are typically looking for a new job when times get tough.

Top salespeople know: the more consistent they are, the more reliable they appear. Reliability builds trust, and trust opens doors.

Consistency doesn’t happen by accident. It happens when we commit to a process.

Below are three ways that top performers build in success:

1. They Follow a cadence – Calls, emails, and touches are scheduled, not sporadic.

2. They Deliver value each time – Not every outreach is a pitch. Sometimes it’s sharing an insight, making an introduction, or sending a relevant resource.

3. They Show up the consistently – Whether it’s the first call or the tenth, they bring the same energy, curiosity, and preparation.

Why Does This Matter?

In today’s economy, buyers are more skeptical than ever. A Gartner study showed that 77% of B2B buyers say their last purchase was “very complex or difficult.” Customers aren’t looking for a salesperson to pressure them, they’re looking for someone they can trust to guide them (more on that in a couple weeks). Customer’s being more informed also makes trust crucial especially if they are informed with incorrect information from the internet (just because it is on the internet does not make it truth).

We need to be the go-to person to help our customers if we are going to have a successful career in sales. That means building trust, and consistency is crucial for this. It’s like trying to build a house. We need to make a foundation, then build walls, then a roof. Get them out of order and the whole thing collapses.

Master the Art of Influence: Build Trust, Drive Sales, and Lead Effectively

Are you ready to become the magnetic force that attracts top performers and your best customers?

I’m Kevin Sidebottom—keynote speaker, sales trainer, and author—and I help organizations unlock the power of influence to achieve breakthrough results.

In this blog, I reveal why influence is the ultimate currency in business and leadership—and how you can use it to:

✅ Motivate customers to stay loyal and buy again

✅ Build trust and engagement with your team

✅ Transform your leadership approach to inspire stronger performance

With decades of experience studying why people buy and how leaders earn loyalty, I equip sales professionals and executives to deliver lasting value, strengthen customer relationships, and drive higher revenue.

👉 Featured Resources to Grow Your Influence:

· Email: kevin@kevinsidebottom.com

· The Sales Process Uncovered Membership

· The Sales Process Uncovered (Book on Amazon)

If you’re serious about elevating your sales process, leadership impact, and team performance, this blog will show you the path.

Winning Every Sale Isn’t the Goal

Most salespeople start their careers believing one thing: success means winning every deal. But the reality is, even the best salespeople lose far more often than they win. That’s right we don’t win every sale. I know, I know you hear it all the time from “Sales Guru’s” that say they are amazing and they win every sale. That is not the case unfortunately…

The Trap of “Always Be Closing”

Sales culture often glorifies closing as the ultimate measure of success. The average close rate across industries is 29% according to (HubSpot, 2024) report. That is a low percentage of success per sale. This means that there is a great opportunity, but let’s get into the “close” that I take issue with.

I won’t say hate, but I firmly dislike “closing” because closing is coming to an end. We don’t want to come to an end in the relationship with the customer. We want them coming back to us again and again for more business. So how can we reframe this notion that we should be closing… I tend to think of the end of this sale as in a dating relationship with someone. We don’t close unless we want that one night stand. If we value the other person, we focus on generating a relationship.

When speaking on stage or training sales team, I often walk people through the fact that each customer has an acquisitional cost to add them to our database and manage through the sales process. That means if we only make one sale to a customer and have to chase another customer our costs are increasing. Having customers coming back again and again means we have lower costs and make more profit.

Don’t focus on the close, but focus how you can go through the file cabinet of opportunities that lie in with the customer and how you can support them not just in one sale, but in becoming a consultive advisor to help them grow their business. The by-product will be more and more sales.

By not focusing on how we can get a quick close today with a product / service and think about how we can become a trusted advisor to the customer, we will see a better future.

And just because you hear a “no” today , does not mean you won’t hear a “yes” in six months—if you’ve built the right relationship with that customer. Some of my best customers were the hardest to secure at the beginning, but I kept showing up, and kept adding value which in turn made me the go to person when they needed help. This is when I also made more profits as well.

Have a great week!

Master the Art of Influence: Build Trust, Drive Sales, and Lead Effectively

Are you ready to become the magnetic force that attracts top performers and your best customers?

I’m Kevin Sidebottom—keynote speaker, sales trainer, and author—and I help organizations unlock the power of influence to achieve breakthrough results.

In this blog, I reveal why influence is the ultimate currency in business and leadership—and how you can use it to:

✅ Motivate customers to stay loyal and buy again

✅ Build trust and engagement with your team

✅ Transform your leadership approach to inspire stronger performance

With decades of experience studying why people buy and how leaders earn loyalty, I equip sales professionals and executives to deliver lasting value, strengthen customer relationships, and drive higher revenue.

👉 Featured Resources to Grow Your Influence:

· Email: kevin@kevinsidebottom.com

· The Sales Process Uncovered Membership

· The Sales Process Uncovered (Book on Amazon)

If you’re serious about elevating your sales process, leadership impact, and team performance, this blog will show you the path.

The Engagement Power of Trust and Autonomy

There is nothing worse than being micromanaged by someone. This is an energy and effort drain to constantly having to look over our shoulders to see if we are making a manager, or leader happy. Constantly having to report out on my effort and to be told I should change this to make the impact was frustrating. I had a new manager that was also a friend one time and it was hard to manage the relationship.

I thought I could, but when the manager would constantly tell me how to do things, change the report to this view, put in these bullet points, it caused me to stop and say, why do you have me doing this? I can be kind of blunt so I’m sure when the manager heard this their blood pressure skyrocketed as well.

It took many discussions to figure out the relationship because I had a friendship, but think about how many people report to micromanagers that are not friends with them. I shared a few weeks ago that engagement globally fell to 21% in 2024. Now there are various reasons why, but one can be attributed to leaders and managers that are micromanaging their teams.

Involve, Don’t Dictate

As a high driver, it is sometimes hard for me to let my son do things his way when I have had the experience. Sometimes I am even surprised by the fact that it worked out even when not doing it my way. Yes, I have a lot to learn about parenting, but the same is true for leadership and management. They need to let the employees develop their own way of doing things and not be told exactly how to do everything. By dictating to people we are in essence training robots. Sometimes we can be surprised at the outcome being better or more efficient than our ways.

Autonomy Is Key

We can have Key Performance Indicators (KPI’s) about the position and show the employees how to perform certain tasks, but then leaders and managers need to step away and let the employees take ownership of the operation so they feel like they are apart of the decision and outcome. If we direct every movement when things go wrong, the employee will just throw up their hands and say it’s not their fault. By giving autonomy, the employee will take ownership on how the task / operation is done and want to improve and make better the outcome. They will want to keep showing up and improving to become more efficient.

Tell the Truth

The best leaders take ownership of the outcome when things fail and give credit to the team when missions succeed. They also tell the truth. We are not talking about my bluntness here. We are talking about when the leader makes a mistake they don’t brush it under the rug, they acknowledge it and own the mistake. Transparency and ownership of the issue allows the employees to see the value that the organization has and they will start taking more ownership and communicate better as well.

The employees are looking at the leadership to see how they are to engage in the environment so it is up to leadership teams to make sure they are doing thing well as a guide to what success looks like. They need to sometimes show, then step away to let the employees lead themselves on the task. Being truthful and transparent will also carry the weight of the mission with the employees allowing them to take more ownership and become more engaged as well.

Hope this helps and here’s to your success Cheers!

Master the Art of Influence: Build Trust, Drive Sales, and Lead Effectively

Are you ready to become the brand of choice for top customers and employees? Kevin Sidebottom—keynote speaker, trainer, and author—shares proven strategies to elevate your sales success and leadership impact.

In this blog, Kevin reveals why influence is the ultimate currency in building lasting relationships. Learn how to:

✅ Motivate customers to stay loyal to your brand

✅ Build trust and engagement with your team

✅ Transform your approach to leadership and sales

With decades of experience studying why people buy and how to inspire loyalty, Kevin equips sales professionals and leaders to deliver exceptional value, ensuring customers return again and again.

Featured Links to Grow Your Influence:

Winning With Others: https://www.kevinsidebottom.com/stopgambling

Kevin’s website: https://www.kevinsidebottom.com

Kevin’s email: kevin@kevinsidebottom.com

The Sales Process Uncovered Membership Page

https://www.kevinsidebottom.com/pricing-page

The Sales Process Uncovered Book

How Recognition and Feedback Boosts Engagement

Last week I shared the numbers from Gallups report that 21% of the workforce globally is engaged and how it cost in the Billions in revenue lost. I also shared why leaders need to help employees see the purpose. If you missed that post check it out. This week I want to further the engagement discussion with one more step that leaders and managers are missing the mark on.

It’s recognition. That’s right something as simple as recognition can help the employees feel so valued and known that they are willing to go the extra mile to move the needle for the organization and customers.

Employees think ping pong tables are novel, but what they want more is to know that they are valued and seen, Without this they have no idea (until the annual review) how well they are doing. Too often when I ask leaders and managers how their employees are doing, they say great, no problems….When I talk to the employees however, they give me this look of lost hope and wishing for something better to come along and make their lives better.

This is a huge disconnect between the leaders and the employees. The answer is simple. There is a lack of feedback to understand how things are going. There are a few ways that this can be accomplished to really fire up the team.

Celebrate the Small Stuff

Leaders and managers can really start the uplift for the employees quickly by celebrating the small stuff. And no, I am not talking about participation trophies here. I am talking about celebrating the fact that someone went the extra mile to do something to help another employee, customer, or department. I hand out coins when I see people at our church doing something like this and you would be amazed at how uplifting that makes the volunteers. I’ve heard people do kudos notes that anyone can write on to give to the person as well. People need to feel seen for the value that they bring.

Make Feedback Real-Time and Real

Employees need more than just an annual check in with leadership. They need regularly checking in and providing feedback as well as not a fake interaction. I have heard guidance from people to do the sandwich effect when giving correction where you give a good compliment, then an area to improve, followed by a good compliment. Employees can smell this coming a mile away and will immediately shut down and feel like the leader is just trying to correct them. This drives engagement into the garbage which is where that management critique sandwich needs to go.

Set up regular check ins with the employee to see how things are going and hear of their wins. Also focus on learning one new thing about the employee each time and build that CRM so leaders can really know the employee. Don’t treat the employees like a cog in a machine.

Acknowledge Effort over results

We have implemented this at home with our kids as well. I am a high driver and remember being scolded whey I did not have all A’s on a report card. It made me feel small and unvalued. Sometimes we don’t get the results we had hoped for even though we put in so much effort.

By focusing on the effort that someone put in, they know that just because a metric may have been missed, they are still valued and seen for the effort that they put forth and are willing to do it again in the future to help the organization hit the goals. If we only focus on the results and not the massive effort employees will stop trying hard and check out.

Leaders can really move the needle with engagement by focusing on these three simple ways. And no you don’t have to master all three at once. Try one at a time and over time leaders and managers will grow the engagement from the team.

Master the Art of Influence: Build Trust, Drive Sales, and Lead Effectively

Are you ready to become the brand of choice for top customers and employees? Kevin Sidebottom—keynote speaker, trainer, and author—shares proven strategies to elevate your sales success and leadership impact.

In this blog, Kevin reveals why influence is the ultimate currency in building lasting relationships. Learn how to:

✅ Motivate customers to stay loyal to your brand

✅ Build trust and engagement with your team

✅ Transform your approach to leadership and sales

With decades of experience studying why people buy and how to inspire loyalty, Kevin equips sales professionals and leaders to deliver exceptional value, ensuring customers return again and again.

Featured Links to Grow Your Influence:

Winning With Others: https://www.kevinsidebottom.com/stopgambling

Kevin’s website: https://www.kevinsidebottom.com

Kevin’s email: kevin@kevinsidebottom.com

The Sales Process Uncovered Membership Page

https://www.kevinsidebottom.com/pricing-page

The Sales Process Uncovered Book

Leaders Need to Communicate Purpose to Jumpstart Engagement

Gallup provided their state of the business report for 2025 and engagement in the workplace worldwide fell for the fifth straight year to 21% costing businesses a total of $438 Billion in lost revenue. Managers feel less equipped than ever before, and let’s sit on the fact for a second that only 21% of the workforce is actually fully engaged. This is being measured in the Billions of dollars.

This is not to be blamed on the employees, or because they are lazy. It is because they don’t feel a sense of purpose when they show up to work. Granted a teller at a bank may not think that they do as much as a first responder, but it is the leaders and managers JOB to equip the employees to know what value they are bringing to the customers and the organization.

If they don’t, well you see the numbers above…

Employees need to feel the sense of purpose of why showing up day in and day out matters. If they don’t, then they will not do the tough things and just mail in their effort dreaming about what the weekend will hold.

Leaders and managers need to define the what the organization is doing for the customers. Especially now that the Millennials and the GenZ’s are in the workforce. They have a greater value on purpose and impact. If they don’t feel it and understand why they are showing up, they will find something else to fill that void. They need meaning, not just tasks.

When I first started in sales and was frustrated because I was not making end roads. That is when my mentor stepped in and let me know why we do what we do. It is to support small businesses that are working hard with products and services that will enable them to be better and work more efficient. That is such a better vision than sell more stuff right!

Leaders and the managers need to also connect the dots to how each role serves the mission that the organization is on. That may mean reviewing the duties and the roles to see how they help other functions of the business and then ask the employees what they like about the position and why. That is right, this is not just a one-way street, this is a collaboration.

I know it may seem daunting with all of the other duties that leaders and managers have, but if the teams are functioning well and working hard without having to motivate them don’t you think your future will get better? I have witnessed organizations that thrive no matter the environment and it is electric. You can feel the energy and why people are working so hard for the mission.

It all stops with the leaders and managers casting the vision and showing each employee why they matter to the mission and hopefully the mission is not just to make numbers for the quarter and make shareholders happy. The mission needs to be greater!

Master the Art of Influence: Build Trust, Drive Sales, and Lead Effectively

Are you ready to become the brand of choice for top customers and employees? Kevin Sidebottom—keynote speaker, trainer, and author—shares proven strategies to elevate your sales success and leadership impact.

In this blog, Kevin reveals why influence is the ultimate currency in building lasting relationships. Learn how to:

✅ Motivate customers to stay loyal to your brand

✅ Build trust and engagement with your team

✅ Transform your approach to leadership and sales

With decades of experience studying why people buy and how to inspire loyalty, Kevin equips sales professionals and leaders to deliver exceptional value, ensuring customers return again and again.

Featured Links to Grow Your Influence:

Winning With Others: https://www.kevinsidebottom.com/stopgambling

Kevin’s website: https://www.kevinsidebottom.com

Kevin’s email: kevin@kevinsidebottom.com

The Sales Process Uncovered Membership Page

https://www.kevinsidebottom.com/pricing-page

The Sales Process Uncovered Book